Simplify your tax withholding process

Fill form

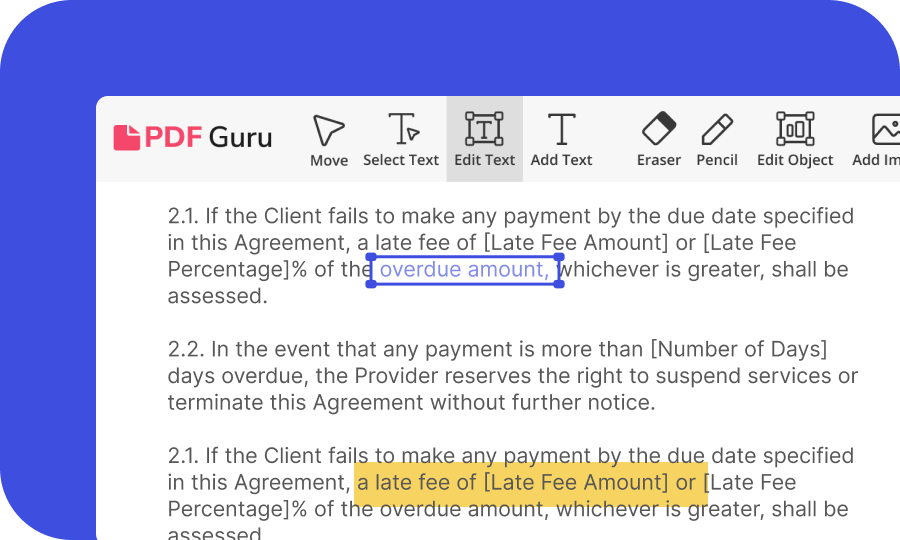

Easily access the blank W-4 form on PDF Master. Our intuitive interface guides you smoothly through the initial steps.

Fill out the form

Use our PDF editor to fill in the necessary information, such as your name, address, and Social Security number.

Download and submit

Review, download your completed W-4, and submit it to your employer, either electronically or printed.

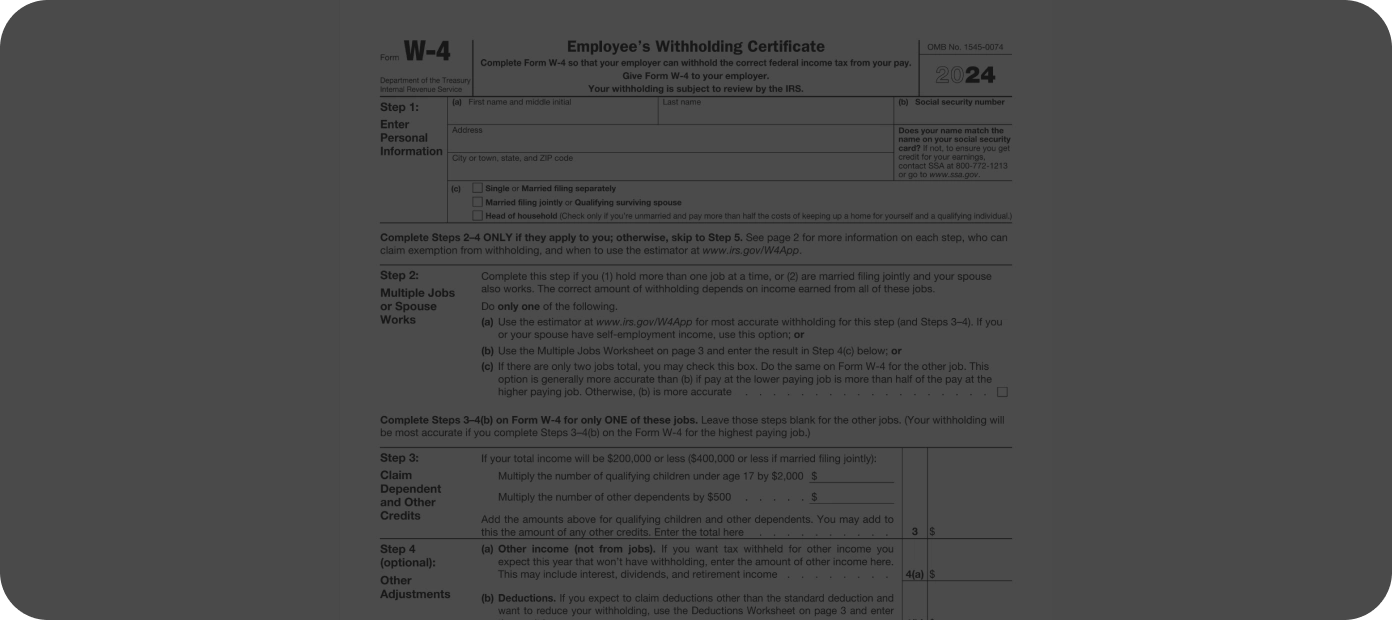

What is a W-4 tax Form?

Think of the W-4 form as a tool that tells your employer how much federal income tax to withhold from your paycheck. It is also known as Employee's Withholding Certificate. Every now and then, this form gets updated to match new tax rules. Filling out your W-4 correctly is important because it affects your tax refund or how much tax bill you'll either incur or owe at tax time at the end of the year. If you don't fill it out correctly, you might end up paying too much or too little in taxes. That's why accurately completing your W-4 is so important.

What is a W4 form used for?

Basically, Form W-4 lets your boss know your tax situation. This includes whether you're single or married, if you have a second job, or other ways you make money, which all affect your tax withholdings and how much you should be paying. Our W-4 Form PDF Filler is really handy for completing this form accurately.

How to get a W-4 form?

Getting an Employee's Withholding Certificate online is super easy with PDF Master, especially when it's time to update your W-4 due to changes in your job or tax situation. You can just click the 'GET FORM' button on this very page, and a bank document will open in a PDF editor. Now you can fill it out with the info you need, save, and download it to your device. Need a paper copy? No problem! We provide a current version of W-4 form, printable and editable.

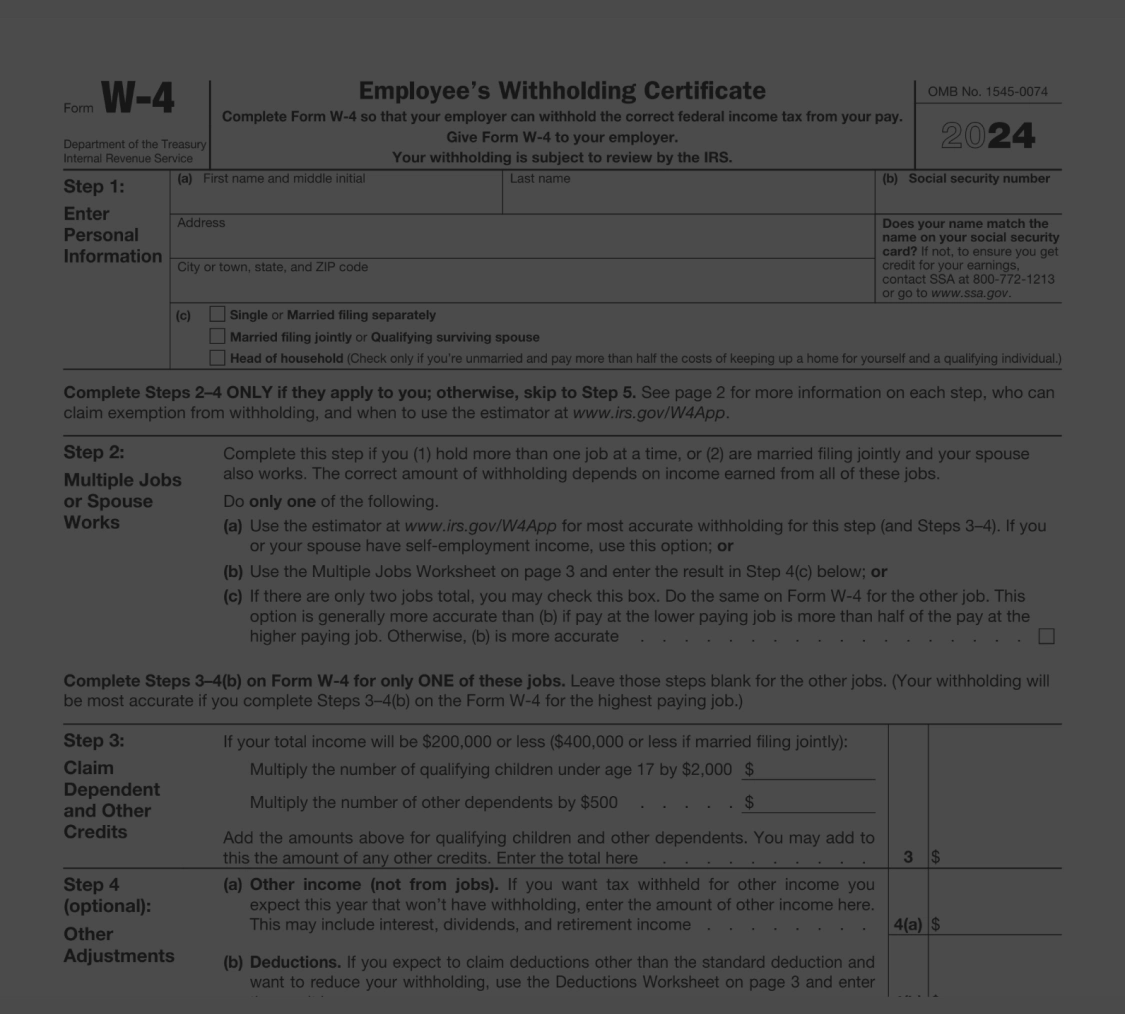

What does a W4 form look like

The W-4 form is a one-page document with a series of fields to be filled out by the employee, detailing your withholdings and exemptions, including whether you are exempt from withholding. It includes sections for personal information, financial details, and specific tax-related declarations. Using PDF Master's editor, you can view and interact with the federal W-4 form, getting a clear sense of its structure and requirements. You can also easily access other federal tax documents for the 2024 tax year.

How to fill out a W-4 form

Start with PDF Master: Use our platform to fill out a new W-4 Form.

Enter personal information: Input your details as required by the IRS. You can use a W-4 withholding calculator to help determine the correct amount of tax cac.

Adjust for tax situations: If you have extra income or things that change your taxes, add those details.

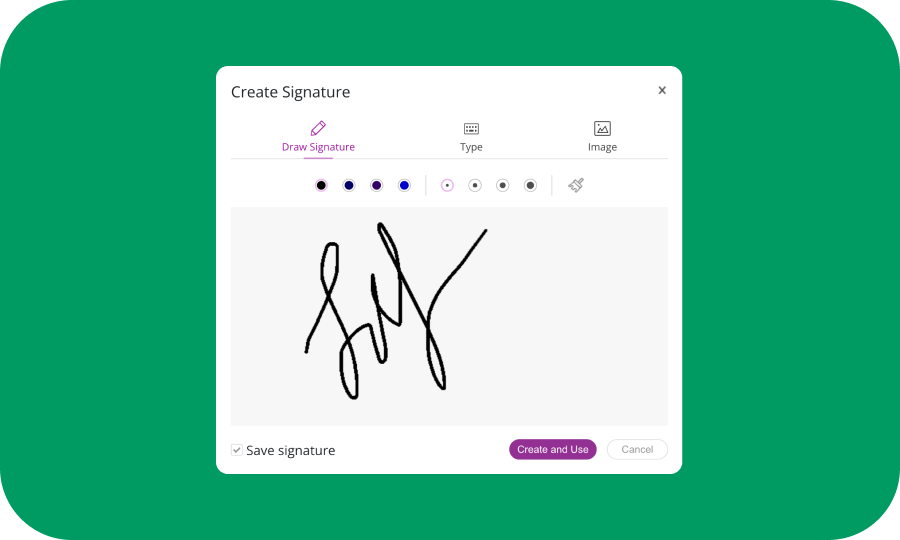

Review and download: Confirm all details for accuracy and download the new W-4 Form.

Print and sign: You can sign the form electronically right on our platform or print it out and sign by hand.

Submit to employer: Send the completed and signed form to your job's HR or payroll department, either electronically or as a printed copy.

Special situations for filling out a W-4 form

Understanding how to accurately complete the IRS Form W-4 is essential for various tax situations. Here's how to approach them:

- How to fill out a W-4 Form as a non-resident alien

If you're not a US citizen and working there, there are special rules for your IRS W-4 form. Basically, you can only claim one allowance and you should write "Nonresident Alien" or "NRA" on the form. You may need to provide additional information, such as your country of residence and tax treaty information. - How to fill out a W-4 form as a single person

If you're single, the W-4 form filling process is generally simpler. You typically claim one withholding allowance for yourself unless you have multiple jobs or other income sources. Also, you may need to provide additional information, such as your tax filing status and whether you have any dependents.

Easily Complete Your W-4 Form Now

PDF Master streamlines your tax filingFrequently asked questions

When did the W-4 Form change?

What should I claim on the W-4 Form?

How to fill out a W-4 Form for my first job?

What are the differences between a W2, W4, 1040, and 1099 tax form?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy