Completing your 941 Form has never been easier than with PDF Master

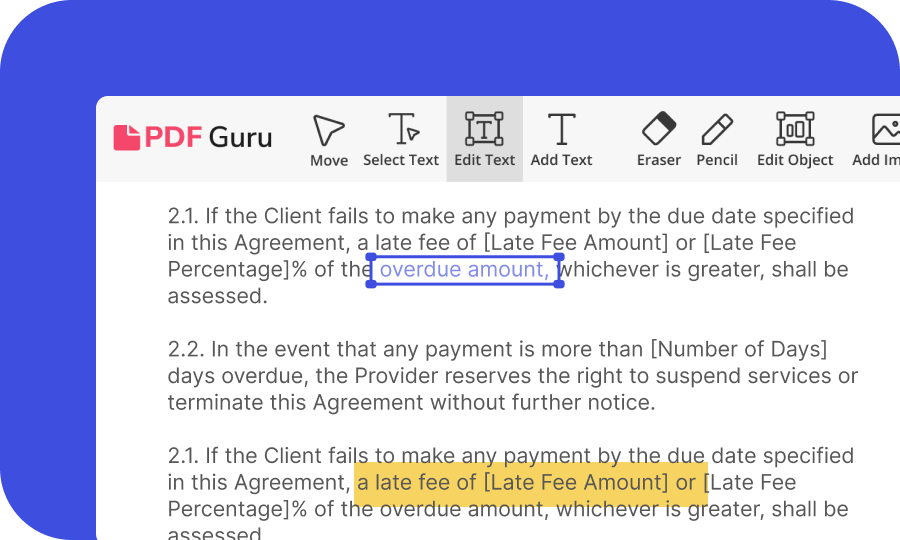

Input your details

Add all the required information to your 941 Form with the help of PDF Master

Download the form

Download your finalized Form 941 as a PDF file. You can now choose to print it out either in color or black and white

Submit the form

Send your completed Form 941 for 2023 electronically or by mail, together with the other required documents

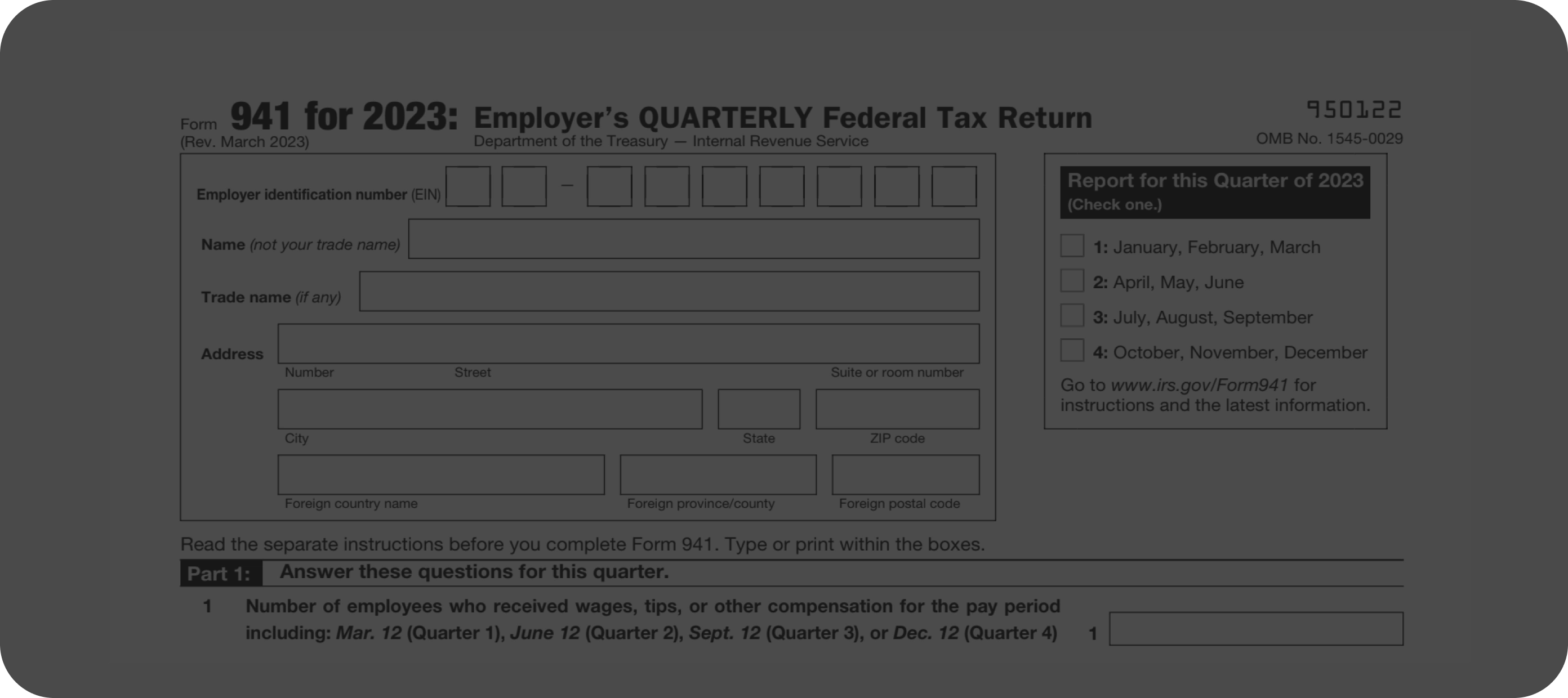

What is Form 941?

Form 941 is also known as the Employer's Quarterly Federal Tax Return. In short, it is a document used by employers in the United States. Through it, federal income taxes withheld from employees' wages are reported. But there is more. Social security contributions made during a fiscal quarter are also reported with this form. Such quarterly submission makes it easier: the IRS can actually monitor tax payments more efficiently.

What is the 941 Tax Form used for?

You might have also heard of the 941-x Form but don’t know the difference between the two. In a nutshell, this is needed to correct any mistakes that have been made in the regular document. Form 941-x instructions are relatively easy to follow, but make sure to get them right to avoid further edits.

When are Form 941s due in 2023?

The 941 Form is on a quarterly basis, which means there were as many as four deadlines in 2023. Here are the dates:

- May 01, 2023

- July 31, 2023

- October 31, 2023

- January 31, 2024

Please note that it is absolutely critical to meet these deadlines. Only then will you not run into penalties and allow the IRS to do its job for the good of all.

How to fill out a 941 Form online

Click the "Fill Form" button at the top or at the bottom of this page

An Editor window will now appear, and you’ll be able to add all the information required

Follow the IRS requirements carefully to fill out Form 941 for 2023

Once you’re done, PDF Master will let you download your completed 941 Form 2023 PDF file

How do I submit a 941 Form?

Submitting Form 941 is very simple. Just use our service on PDF Master to complete all form sections, including Form 941 Schedule B, and verify all the information you enter before proceeding. Once you finish, choose between paper or electronic submission (recommended for greater accuracy and rapidity). Those who submit electronically, however, must also wait for a confirmation receipt from the IRS. Alternatively, bring your printed documents to the nearest IRS office.

The Best Way to Fill Your 941 Form

Frequently asked questions

Who needs to file Form 941?

What do you need to report on Form 941?

Can you file Form 941 electronically?

Where to mail Form 941 for 2023?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy