Fill your W-3 Form in just a few minutes with PDF Master

Add your details

Use our Form W-3 editor to put in your personal information and make sure everything is correct.

Print it out

Once you’ve filled in all the necessary details, download the W 3 Form PDF or print it out.

Submit the form

Visit a tax reporting facility or submit your completed W-3 Form 2023 through the IRS's FIRE system.

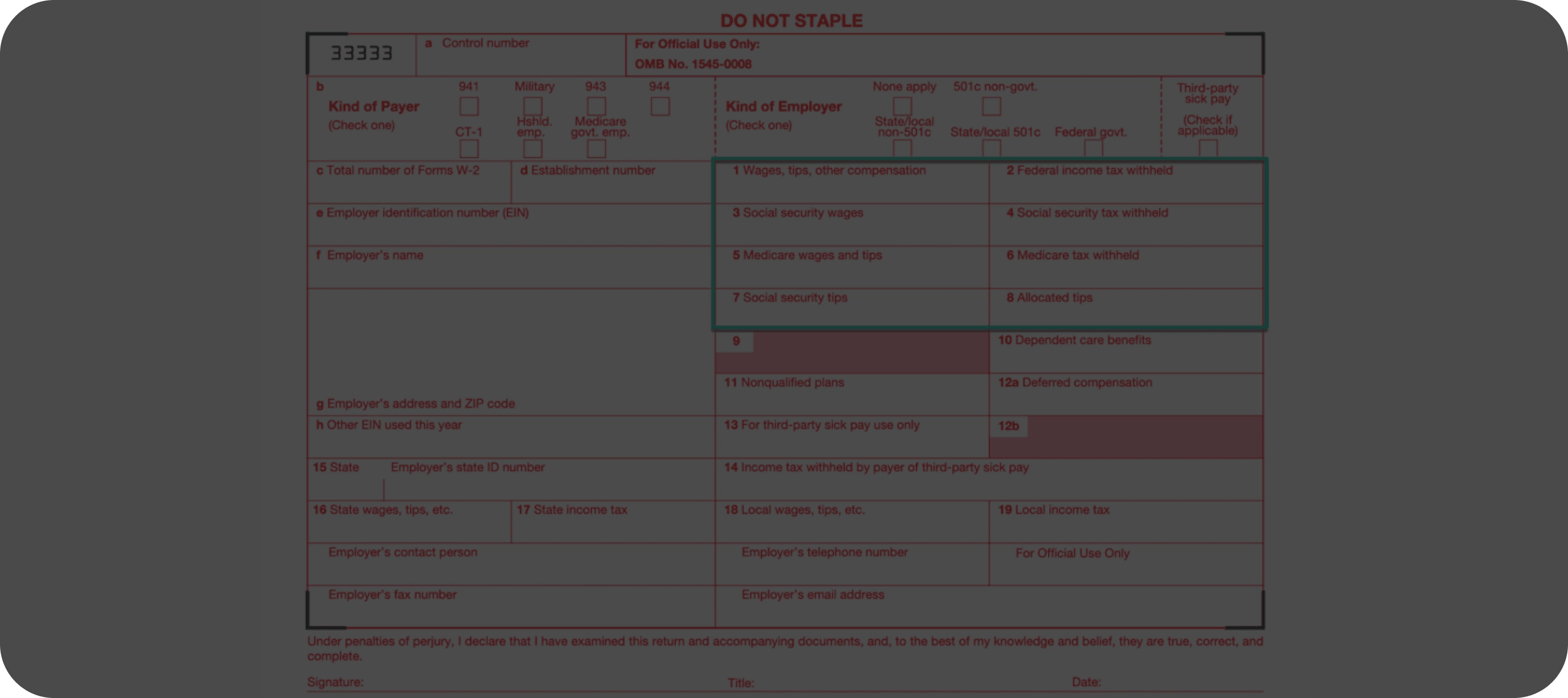

What is Form W-3?

The official name of the W-3 Form is "Transmittal of Wage and Tax Statements”. It serves as a critical component in the employer's tax reporting process. Developed by the IRS, the W-3 Form is instrumental in summarizing and transmitting comprehensive wage and tax information to the Social Security Administration (SSA).

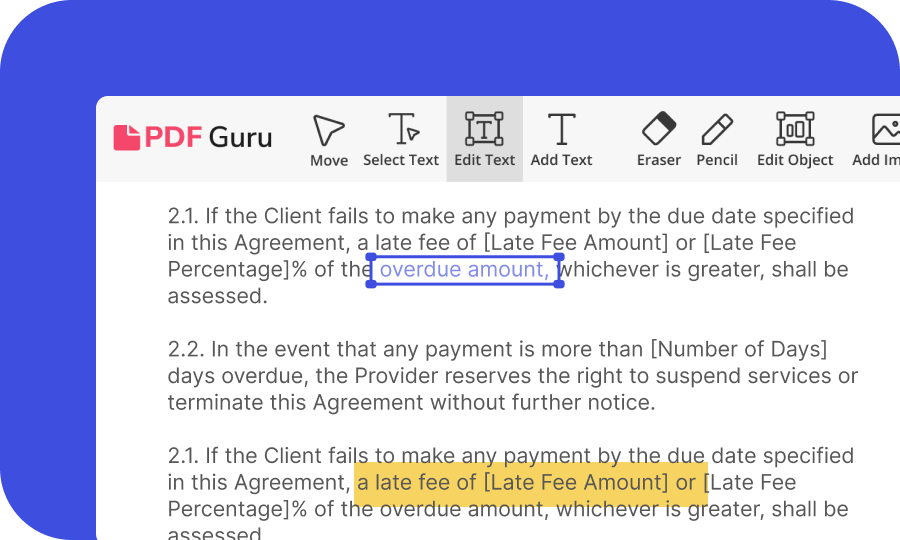

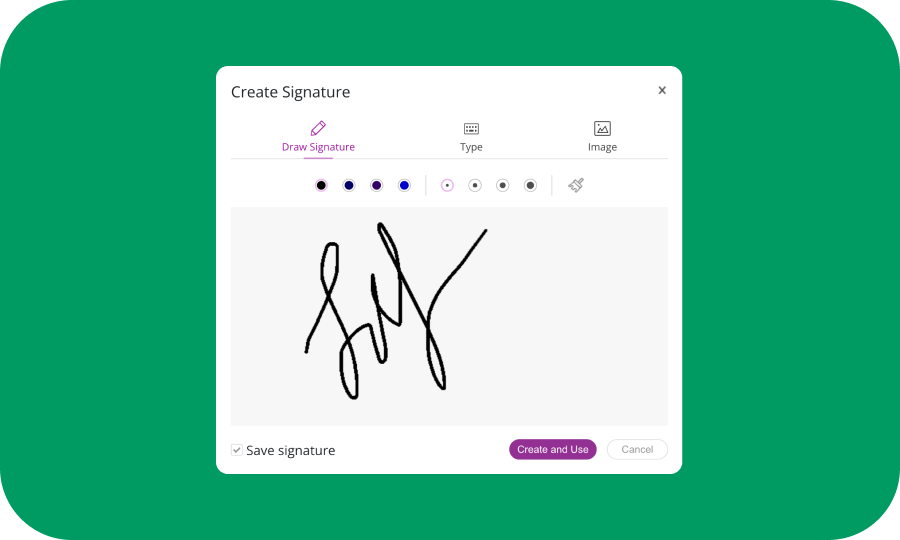

It’s not that easy to fill documents of this kind. Not only because some technical terms are difficult to decipher. But also because you would have to print it out, fill it out, sign it, and with each mistake you would have to start the process all over again. For this very reason, PDF Master comes to your aid. With it, you can fill out the W-3 Form directly online, sign it, and print it without any problems. In short, at least one worry in paying your taxes is alleviated!

Once completed, the W-3 tax form, along with the corresponding W-2 forms, is submitted to an authorized SSA facility. The employer is responsible for ensuring the accuracy of the information provided before submitting the document. The form W-3, much like the I-9 form for employment eligibility, plays a pivotal role in maintaining legal compliance and transparency in workforce reporting.

What is a W-3 Form 2023 used for?

The W 3 Form definition is pretty clear: its goal is to facilitate tax reporting by employers. In other words, it makes their life easier by capturing and enlisting crucial information such as the employer's name, address, and Employer Identification Number (EIN). It also includes all employees' total wages, Social Security, and Medicare wages, making it easier to accurately report financial details to the SSA.

When are W-3 Forms due in 2023?

The next deadline to submit W-3 forms is January 31, 2024. That’s the case both for in-person and online submissions. Make sure you submit it by the due date because only this way you will avoid penalties. Also, don’t forget to submit the W 3 Form online along with the relevant W-2 forms.

How to fill out a W-3 Form online

Locate and click the "Fill Form" button specific to the W-3 tax form

In the opened Editor window, put all the essential information — make sure to type everything carefully

Check with the IRS requirements for the W-3 Form (2023 version)

Once all details are entered, your printable W 3 Form download will be ready as a PDF file

How do I submit a W-3 Form?

You have 2 options to submit your W-3 Form: online or physically. For the first option, just use the IRS’s electronic submission system; it’s the easiest and fastest way. Otherwise, you can print your form and bring the paperwork to the closest tax return acceptance center.

Compete the W-3 Form Quickly

Frequently asked questions

What’s included in a W-3 Form?

What information needs to be included in the W-3 Form?

What is the difference between a form W-3 and a W-2?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy