Elevate form filling with PDF Master

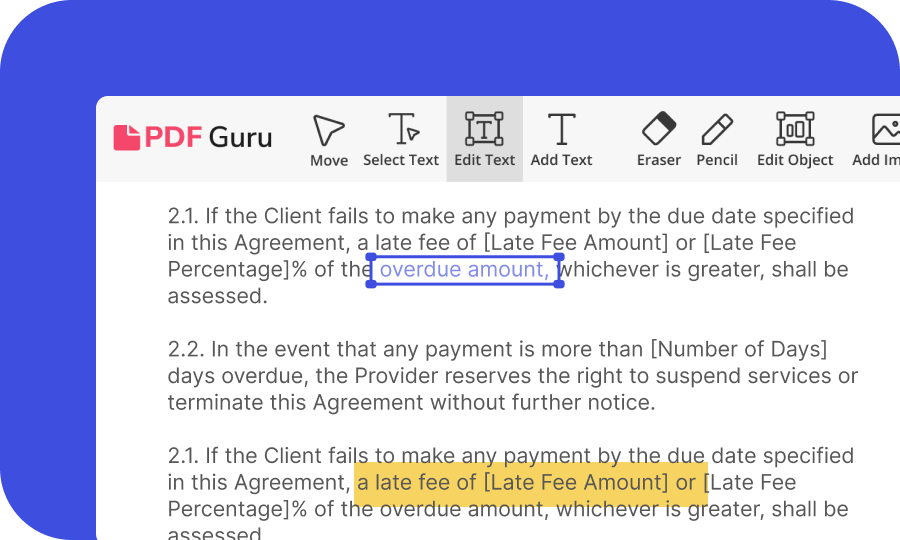

Access and fill out the form

Start filling out IRS Form 2553 easily on PDF Master. Our intuitive PDF editor lets you complete the form seamlessly.

Review and customize

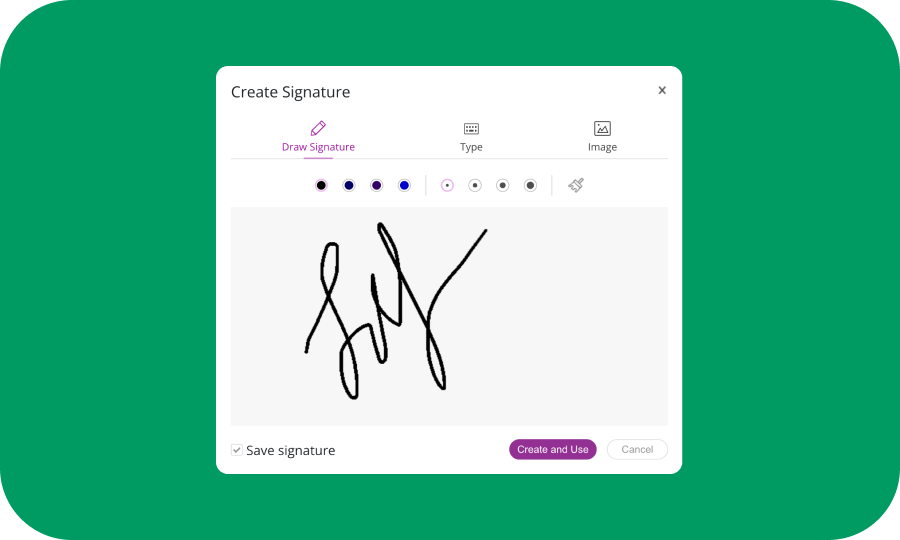

Use PDF Master's tools to add text and ensure all information is accurate and complete. Remember, digital signatures are not permitted by the IRS, so leave signature fields blank for manual signing.

Download and use

Securely download, print, and sign your completed Form 2553 with a pen. File and save it for future use, maintaining a personal copy in standard PDF format.

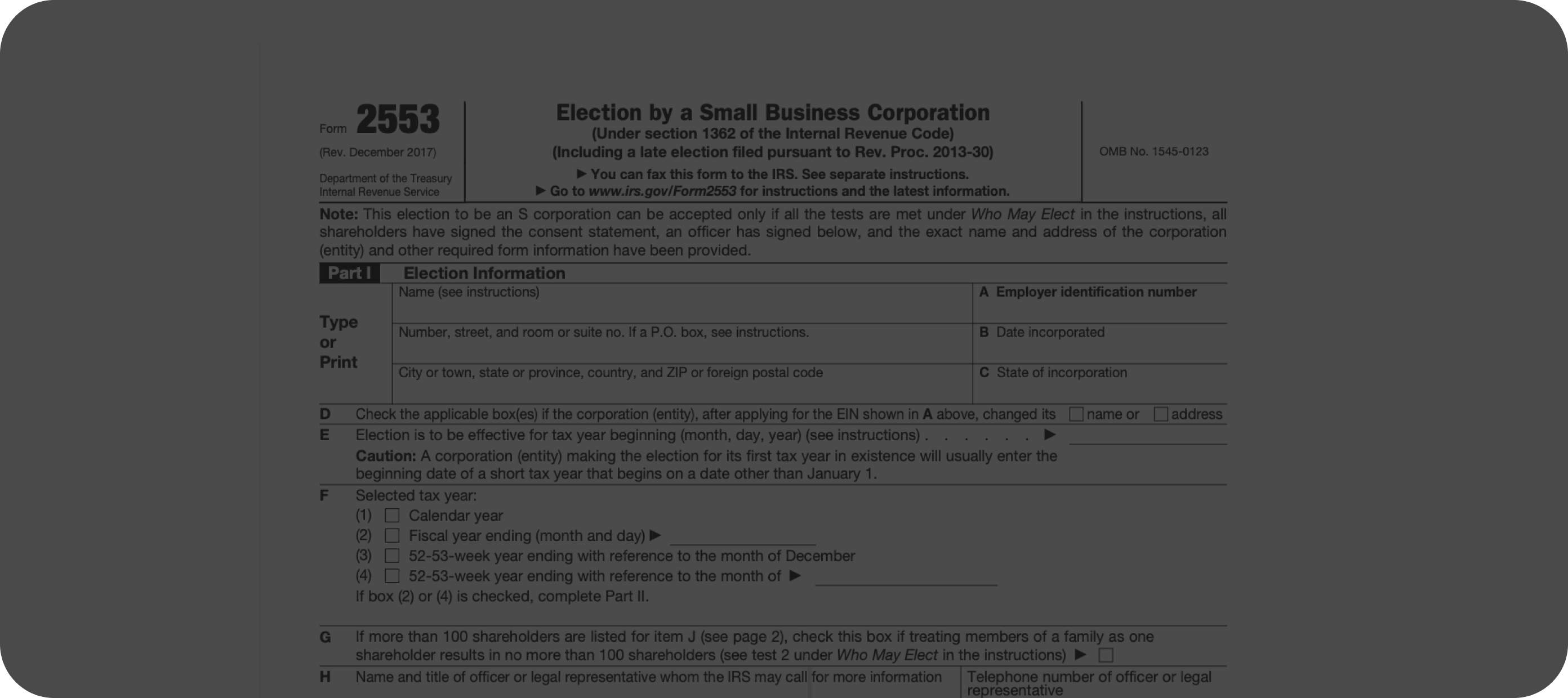

What is form 2553?

Form 2553, also known as Election by a Small Business Corporation, is essential for businesses seeking S corporation status. This status allows a small business to be taxed similarly to a partnership or sole proprietorship, rather than like a regular C corporation. This means the business profits and losses are passed through to the personal tax returns of the shareholders, instead of being taxed at the corporate level.

So, S corporation shareholders can save money overall on federal taxes compared to a regular corporation. Filing IRS Form 2553 streamlines the process of income tax for small Limited Liability Companies (LLC).

Understanding how to fill out and file the IRS Form 2553 is crucial for strategic tax decisions and benefits. It's the gateway for small businesses to be taxed under Subchapter S of the Internal Revenue Code, which can offer more favorable tax conditions compared to other corporate tax structures.

What is IRS Form 2553 used for?

IRS Form 2553 allows corporations to elect S corporation status for tax purposes, impacting taxation and potential benefits. The S Corp Form 2553 is a strategic business decision with significant financial implications. This election means profits, losses, deductions, and credits flow through to shareholders, potentially resulting in tax advantages under certain conditions.

By electing S corporation status, businesses can avoid double taxation on the corporate income and ensure that shareholders are taxed only on their personal income. This setup is particularly advantageous for small businesses that meet the eligibility criteria, as it can lead to significant tax savings and a more streamlined tax reporting process.

Where to file form 2553?

To file Form 2553, you have two options. For online submission, visit the ElectSCorp website. Here, you can submit your manually signed form digitally, offering a convenient option for those eligible to use this service. Alternatively, if online submission through ElectSCorp is not feasible, you can file Form 2553 via mail or fax. To do this, check the latest Form 2553 Fax Number and mailing addresses on the Internal Revenue Service website.

It's vital to ensure accurate submission, whether through ElectSCorp or via mail/fax, to avoid any delays in processing your S corporation status. Remember, business owners must manually sign IRS Form 2553, as digital signatures are not accepted by the IRS.

How to fill out form 2553?

Start on PDF Master: Access our platform and open the blank Form 2553 (Election by a Small Business Corporation).

Enter corporation details: Fill in your corporation's name, address, Employer Identification Number (EIN), and the tax year for the S corporation election.

Complete shareholder consent: Ensure every shareholder's name, address, and shares are listed, with their signatures and the dates they acquired the shares.

Review and download: Carefully check all details for accuracy. Download and print the form, as digital signatures are not accepted by the IRS.

Manual signing: Have all required parties, including shareholders, manually sign the printed form.

File the form: Either submit the signed form online via ElectSCorp or send it to the IRS by mail or fax, using the current fax number and mailing address from the IRS website.

When to file form 2553?

Submit IRS Form 2553 within two months and 15 days after the start of the tax year for which the election is to take effect. The Internal Revenue Service may accept late elections under specific criteria outlined in their instructions. Understanding these nuances is key for a successful S corporation election.

Simplify Your S Corp Election

Accurate and easy-to-useFrequently asked questions

Where to fax Form 2553?

How to file Form 2553 online?

How do I know if my Form 2553 was approved?

How long does it take to process Form 2553?

Can I amend Form 2553 after submission?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy