Filling your 1099 NEC Form is easy with PDF Master

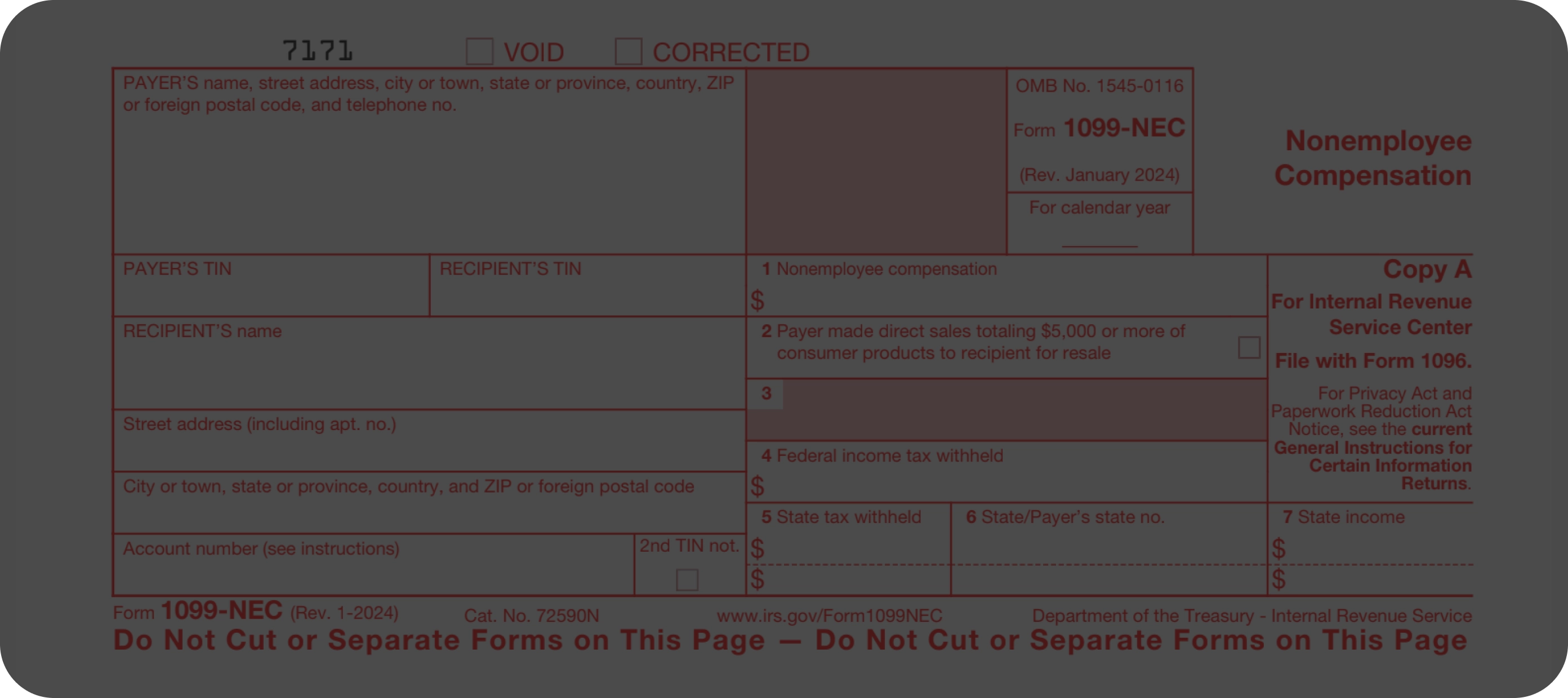

Fill out the 1099-NEC form

Access our 1099 NEC Form 2023 and provide the required information, such as your name, contact details, etc.

Save or print out the form

Download your printable 1099 NEC Form 2023 or simply save the filled-out form as a digital file.

Submit your tax return

Send your completed form to the IRS electronically or present it to them in person.

What is Form 1099-NEC?

It’s likely that many people need clarification about the 1099 NEC Form meaning and usage. This is a tax return form aimed at businesses that engage in non-employee compensation to individuals who earned more than $600 during the year. Originally, this form was used until 1982, when it stopped being required. After that year, businesses would instead use the 1099-MISC Form to report payments to non-employees. However, the IRS reintroduced tax form 1099-NEC in 2020 to separate non-employee compensation payments from miscellaneous income reported on the 1099-MISC form.

What is a 1099-NEC tax form used for?

- You paid someone who is not employed by your business

- The payment was made for a service falling within the course of your business

- The receiver is either an individual, an estate, a partnership, or a corporation

- The total annual amount of the payment is at least $600

The compensation to a non-employee can take the following forms:

- Monetary fees

- Benefits

- Prizes

- Commissions

- Any other form of compensation

Who must file a 1099-NEC?

Form 1099 NEC 2023 must be filed by any business that pays non-employees at least $600 in a year for services rendered by them. Additionally, filing the form becomes necessary when you withhold federal income tax from the payment of someone who isn’t your employee. If you’re liable to fill out the 1099 NEC Form and you fail to do so, you may incur heavy penalties. So, it’s crucial that you report your non-employee payments using our easy, online filler complete with all relevant Form 1099-NEC instructions.

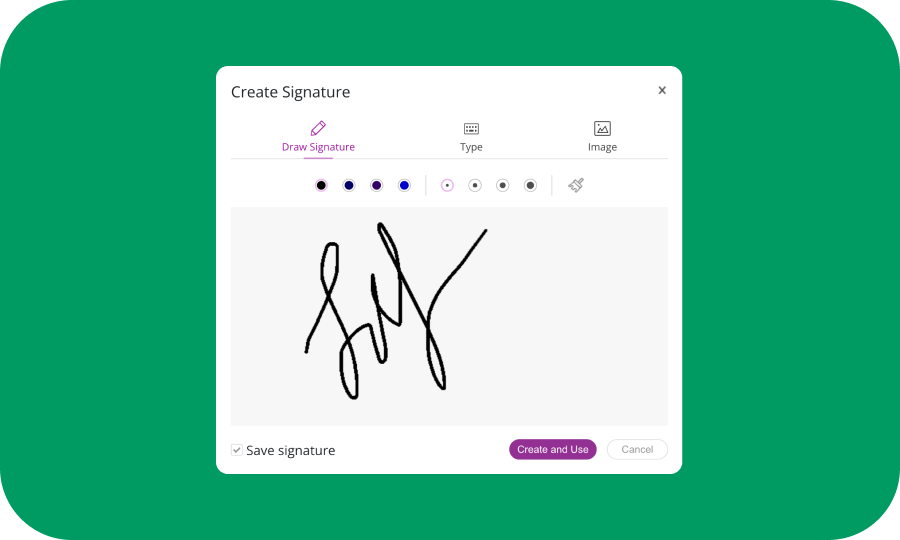

How to file Form 1099-NEC?

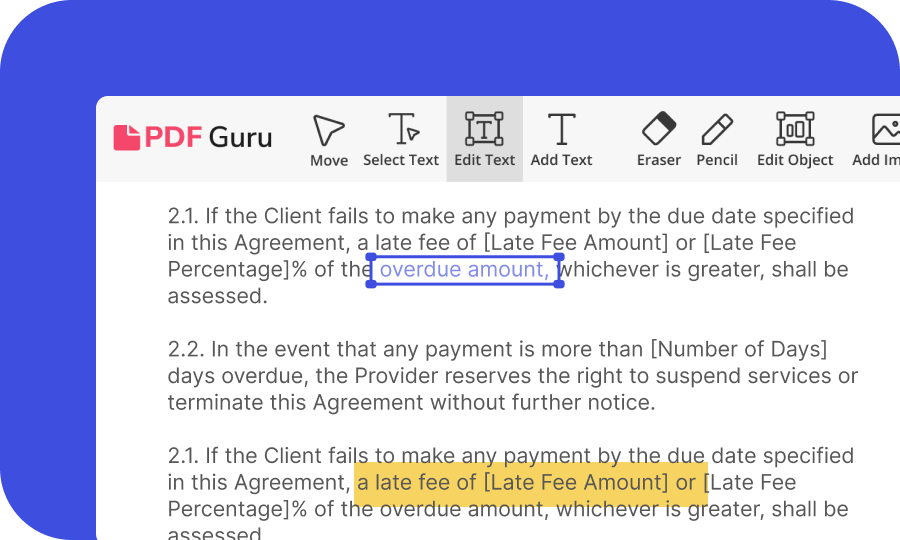

Click on the Get Form button

Fill out the complete form, providing all the required data, such as your name, address, TIN, etc

Review all the information you’ve given

Download the completed, printable 1099 NEC Form 2023

What is the deadline for 1099-NEC?

Form 1099-NEC needs to be filed before January 31, just like most other tax forms. Failure to submit it by the deadline may lead to a penalty. Luckily, filling out the form is quick and easy with our tool. Once you’ve filled it out, there are two main ways to present the data. You may use the IRS Taxpayer Portal and simply upload the digital version of your form. Alternatively, you could always print out your 1099-NEC Form 2023 and mail it to the IRS processing center near you.

Complete Your 1099 NEC Form Hassle-Free

Frequently asked questions

I received a 1099-NEC. What do I do with it?

When is Form 1099-NEC due?

Where do you send 1099-NEC Forms?

How much taxes do you pay on a 1099-NEC?

What is the difference between 1099-MISC and 1099-NEC?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy