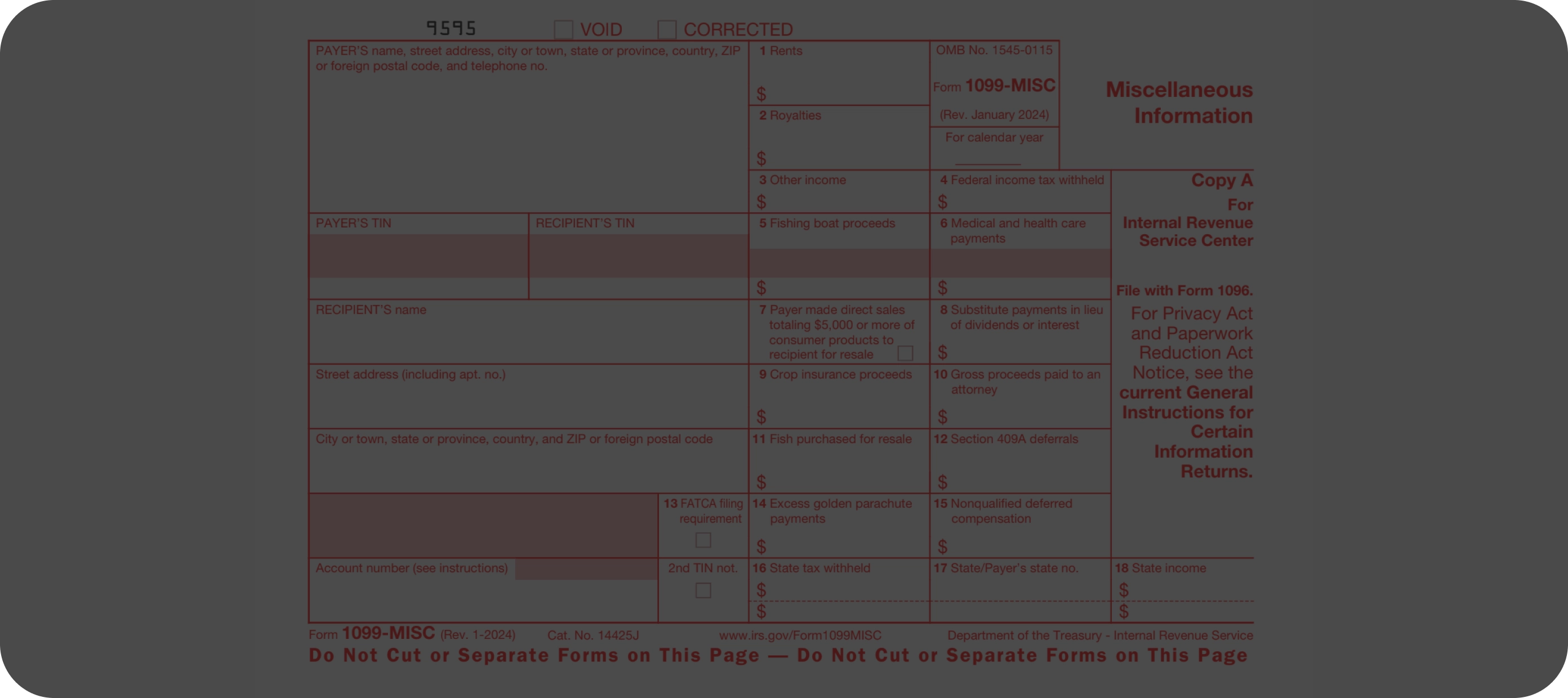

How to fill out a 1099 MISC Form

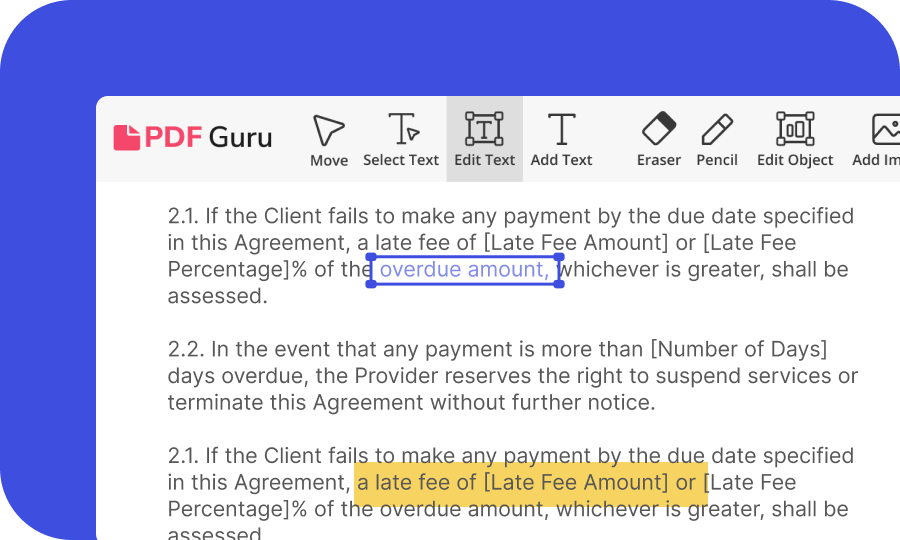

Add your info

Use our PDF filler to input your personal details, contacts, and other required information.

Save or print out the form

Save or print the 1099-MISC Form 2023 using our tool from any device.

Submit your tax form

Submit your tax form. Choose whether to send the form by regular post or file it electronically.

What is a 1099-MISC Form?

A 1099-MISC Form is an important document used by the IRS to report on specific types of non-employment income. The 1099 MISC Form is generally used to record specific income, like royalties, rents, prizes, and other expenses like medical or attorney payments. For example, landlords might issue a Form 1099-MISC to report rent they receive in certain business-related rental situations. This shows the total rent they've paid during the tax year, along with the associated taxable amount.

What is a 1099-MISC Form used for?

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $5,000 for consumer products you sold anywhere other than a permanent retail establishment.

Alternatively, if you earned at least $600 from:

- Rental payments (e.g., real estate agents and property managers reporting rent to property owners or reporting office space rent paid)

- Prizes and awards

- Medical and healthcare payments within your business activities

- Proceeds from crop insurance

- Cash payments for fish or aquatic life acquired from fishermen

- Cash payments from specific contracts to individuals, partnerships, or estates

- Payments made to attorneys

- Other miscellaneous income payments

Who must file a 1099-MISC?

Anyone involved in a business or trade receiving payment from another business entity will have these payments reported to the IRS. But only if they are over a certain amount during the course of the tax year. More precisely, any person or organization that pays another person or business $600 or more in a calendar year is obliged to send out a 1099 MISC Form.

Such payments must be reported to the IRS (Internal Revenue Service) and to the income recipient. So if you receive a 1099-MISC form, make sure to include this income on your tax returns, as you're liable to pay any taxes due on this sum. However, all payments made to employees, including income, insurance payments, retirement contributions, and travel expenses, are to be included on Form W-2.

The 1099 MISC Form 2023 comes in several parts. All the parts in black should be completed, while Copy A (in red) is for IRS use only. You must include your name, address, and tax number, as well as the recipient’s name, address, and Social Security number. You’ll find that using PDF Master makes the whole process quick, easy, and precise.

Once the Form 1099-MISC has been completed, the copies go to the following:

- Copy 1 - to the recipient’s state tax department

- Copy B - to the recipient

- Copy 2 - to the recipient for their state tax return

- Copy C - retained by the payer for their records

How to File a 1099-MISC?

Click on the Form Fill button below

Complete the tax form 1099 MISC in the editor window

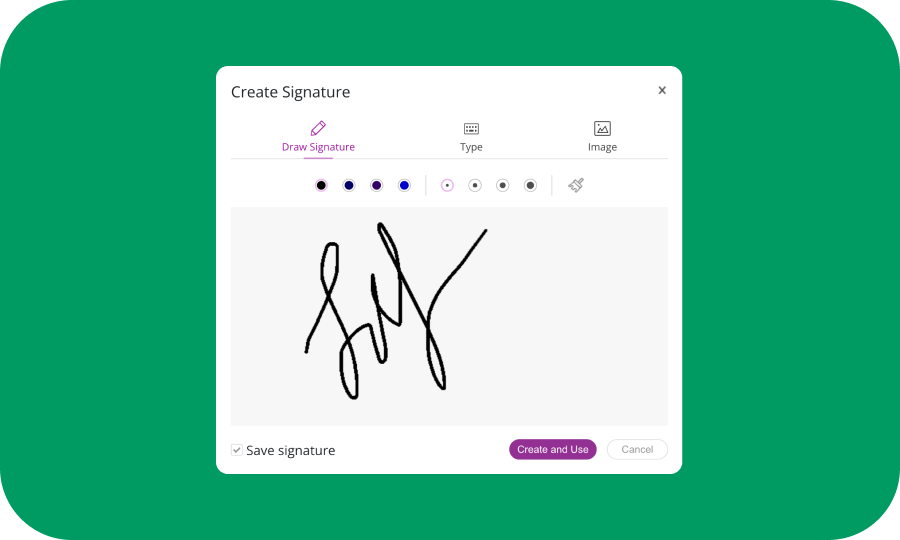

Use the electronic signature to sign and date the PDF

All copies can be sent in 1099-MISC printable form via regular mail or electronically using the IRS’s FIRE system

Fastest Way to Fill 1099-MISC

Frequently asked questions

What is the deadline for Form 1099-MISC?

Where do you send 1099-MISC forms?

How much taxes do you pay on 1099-MISC Forms?

What is the Difference Between 1099-MISC and 1099-NEC?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy