How to fill out the 1098-T form

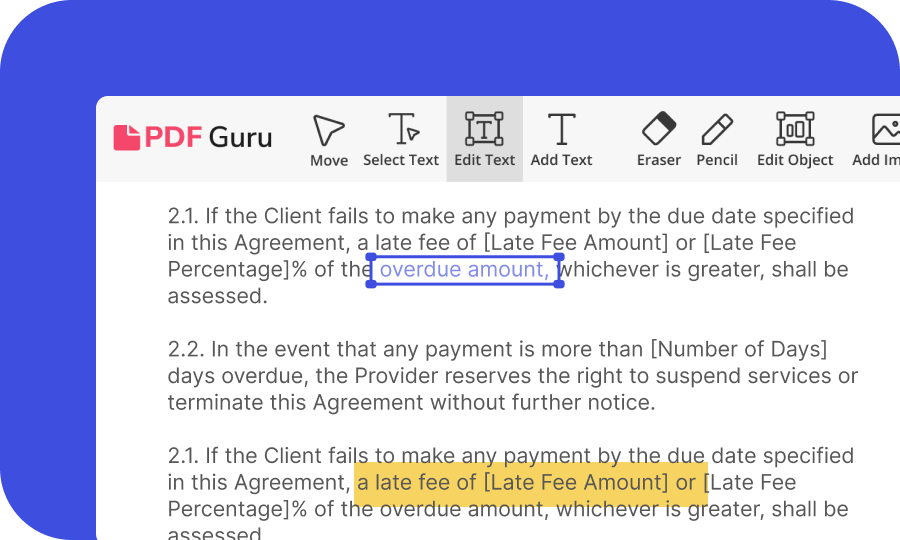

Access the form

Log in and click "GET FORM" to open a blank 1098-T in our versatile PDF editor, already set up and ready for you.

Edit and customize

Use our wide range of editing tools to fill in all the necessary details. Ensure every detail is captured correctly, reflecting the student's educational expenses and scholarships.

Save and submit

Once you've filled out the form, save your progress and download the form. It should be formatted correctly and ready for submission according to IRS requirements.

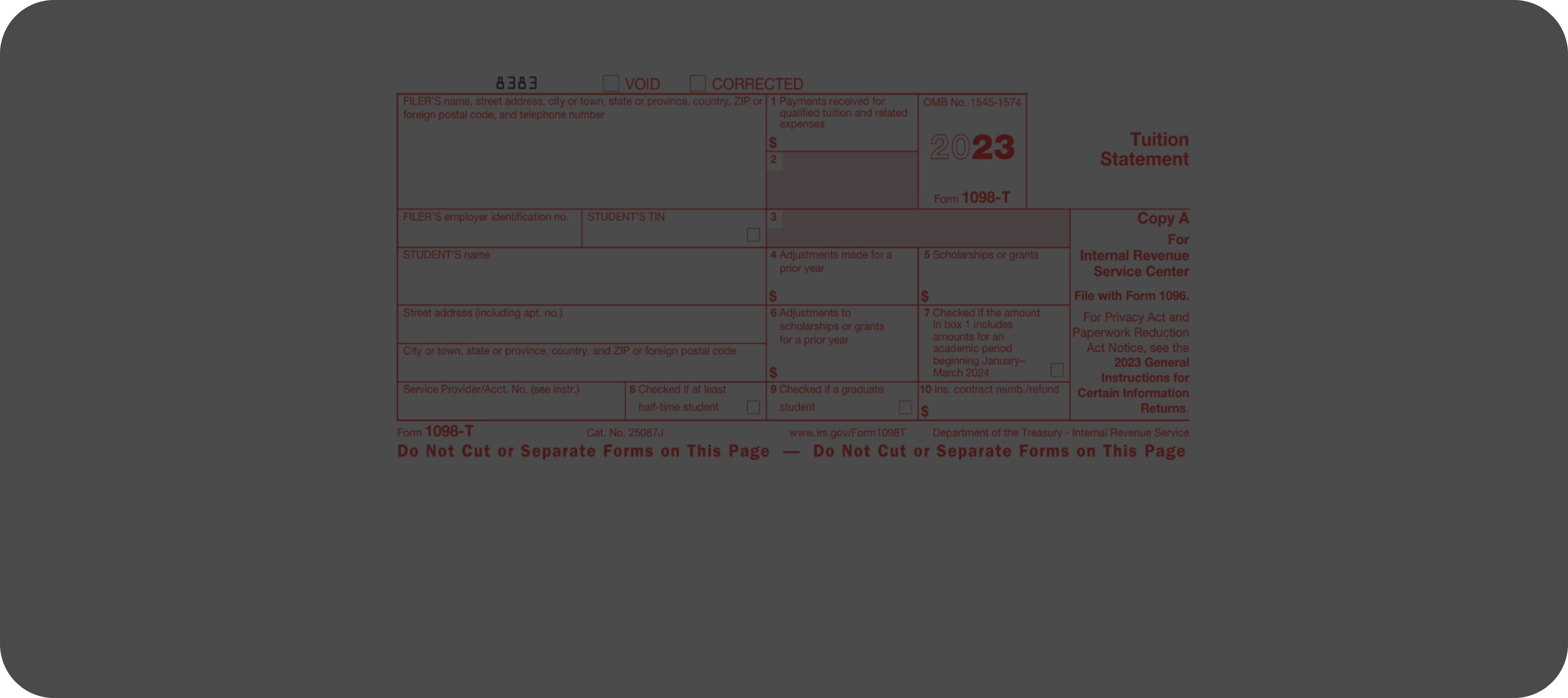

What is a 1098-T Form?

The 1098-T tax form, commonly known as the "Tuition Statement", is a vital document that colleges, universities, and other eligible educational institutions are mandated to issue. This form plays a crucial role in the tax reporting process, detailing payments received and amounts billed for qualified tuition and related educational expenses.

It also serves as a key document for students, enabling them to claim education tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The 1098-T form reports specific expenses, such as tuition fees and charges for necessary course materials. However, it does not include personal expenses like room and board, insurance, or transportation.

Understanding box amounts on the 1098-T

- Box 1: Displays the total payments received for qualified tuition and related expenses during the calendar year.

- Box 2: (No longer in use as of tax year 2018) Previously indicated amounts billed for qualified tuition and related expenses.

- Box 3: If checked, signifies a change in reporting method from the previous year.

- Box 4: Shows any adjustments made by the institution for a prior year's qualified tuition and related expenses.

- Box 5: Reports the total of all scholarships or grants that the institution administered and processed for the student’s account.

- Box 6: Indicates adjustments to scholarships or grants for a prior year.

- Box 7: If checked, means that Box 1 includes amounts for an academic period beginning in the first three months of the next year.

- Box 8: Shows whether the student is considered to be carrying at least a half-time course load.

- Box 9: Indicates if the student is enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential.

- Box 10: (For insurer use only) Reports insurance contract reimbursements or refunds.

Who files a 1098-T form?

The responsibility of filing the 1098-T form primarily lies with educational institutions, not the students. Colleges, universities, and other eligible educational entities are required to file this form for each student who pays for qualified educational expenses. Students who have paid tuition or related expenses in the past tax year need to file a copy of the 1098-T form issued by their educational institution. This includes most college and university students in the United States.

How to fill out the 1098-T form?

Open PDF Master and select the blank 1098-T form.

Enter the student's name, address, and identification number.

Fill in your institution’s name, address, and federal ID number.

In Box 1, input total payments received for qualified tuition and related expenses.

Report any scholarships or grants in Box 5.

Include adjustments from prior years in Boxes 4 and 6.

Fill in Boxes 7, 8, and 9 for academic period, student status, and level of study.

Thoroughly review the 1098-T form and make any necessary corrections.

Save the completed form and distribute it to the student; file with the IRS as required.

Why it's important to file form 1098-T

The 1098-T IRS form is more than just a tax document; it's a critical piece in the financial relationship between students and educational institutions. Here's why it's significant for both parties:

For colleges and universities:

- Compliance with federal regulations: Colleges are required by the IRS to provide 1098-T forms to students who incur qualified educational expenses. This compliance ensures that institutions maintain their eligibility to offer federally backed student aid programs.

- Record keeping and financial reporting: The 1098-T form helps colleges maintain accurate financial records. It's an essential part of their internal accounting and external reporting, providing a transparent record of tuition-related transactions.

- Supporting students’ financial planning: By issuing 1098-T forms, colleges play a role in helping students understand and plan for their educational expenses and potential tax benefits.

For students:

- Eligibility for tax credits: Colleges are required by the IRS to provide 1098-T forms to students who incur qualified educational expenses. This compliance ensures that institutions maintain their eligibility to offer federally backed student aid programs.

- Understanding educational expenses: The 1098-T form helps colleges maintain accurate financial records. It's an essential part of their internal accounting and external reporting, providing a transparent record of tuition-related transactions.

- Reconciling scholarships and grants: By issuing 1098-T forms, colleges play a role in helping students understand and plan for their educational expenses and potential tax benefits.

- Facilitating loan forgiveness programs: By issuing 1098-T forms, colleges play a role in helping students understand and plan for their educational expenses and potential tax benefits.

Streamline Your 1098-T Filing with PDF Master

Frequently asked questions

How do I get my 1098-T form online?

How does a 1098-T affect my taxes?

Where to put 1098-T on tax return 1040?

When do 1098-T forms come out?

Is filing form 1098-T difficult?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy