How to fill out the 1065 Form

Access the form

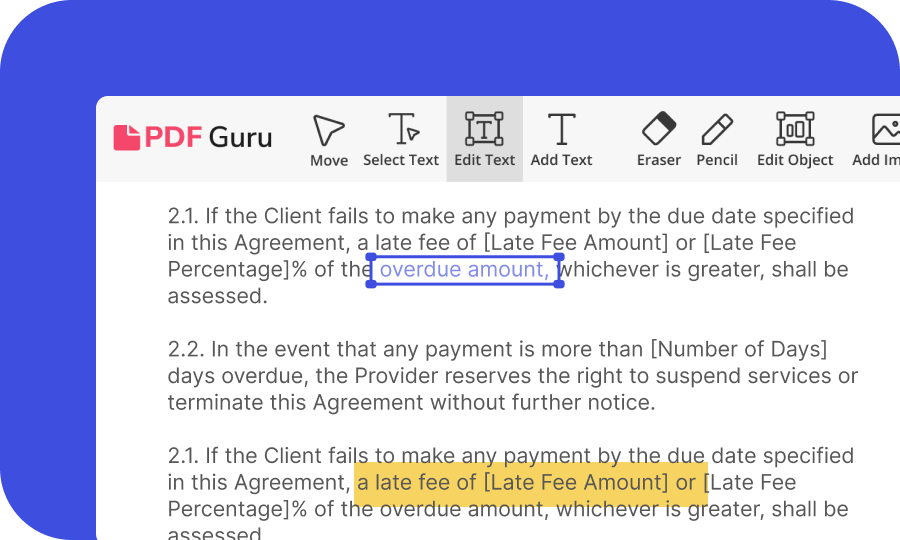

Begin by logging in to PDF Master and clicking "GET FORM". You will access our intuitive PDF editor, preloaded with the latest version of the IRS 1065 tax form.

Edit and review

Use our wide range of editing tools to fill in all the necessary details. Ensure every detail is captured correctly.

Download and use

Once you've filled out the form, save your progress and download the file. It should be formatted correctly and ready for submission according to IRS requirements.

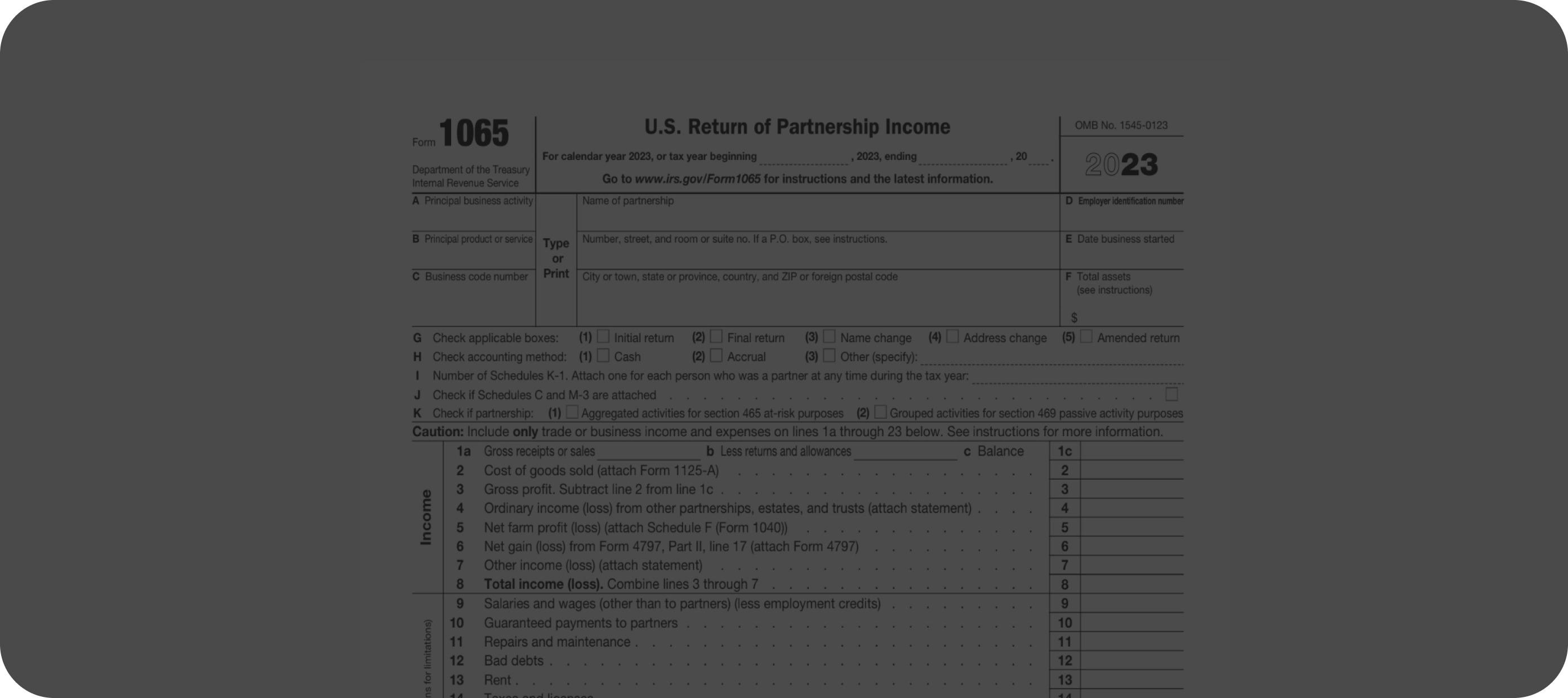

What is Form 1065?

IRS Form 1065 is an essential document for partnership tax reporting. As a mandatory IRS form, it is used to declare the profits, losses, tax deductions, and credits of a business partnership. In the digital age, efficiently managing this form is crucial for accuracy and compliance.

Given its role in the financial reporting of partnerships, accuracy in completing tax Form 1065 cannot be overstated. It provides the IRS with a detailed view of the partnership's financial status, including income, deductions, credits, and losses. Mistakes or inaccuracies in Form 1065 can lead to complications with tax liabilities and audits, making a reliable tool like ours invaluable.

What is Form 1065 used for?

Primarily, tax Form 1065 is used to ensure that each partner in a business partnership is taxed correctly on their share of the partnership income. This form offers a comprehensive view of the partnership's financial status, playing a pivotal role in maintaining financial transparency and integrity within business partnerships.

While its primary function is to report the financial activities of a partnership, tax Form 1065 also serves as a document for internal record-keeping. It allows partners to have a clear understanding of the partnership's financial health, aiding in making informed business decisions. This dual role underscores the importance of a tool that simplifies and streamlines the process of filling out this form.

Who files Form 1065?

Every partnership operating in the United States must file tax Form 1065, regardless of its size or nature. This includes:

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs),

- Other similar business entities.

The requirement to file Form 1065 applies even if the partnership did not earn any income or incur any expenses during the tax year. The range of entities required to file tax Form 1065 is broad, covering everything from small local partnerships to large, multinational joint ventures. This diversity underscores the need for a versatile and easy-to-use platform like PDF Master, capable of accommodating the varying needs of different partnership structures.

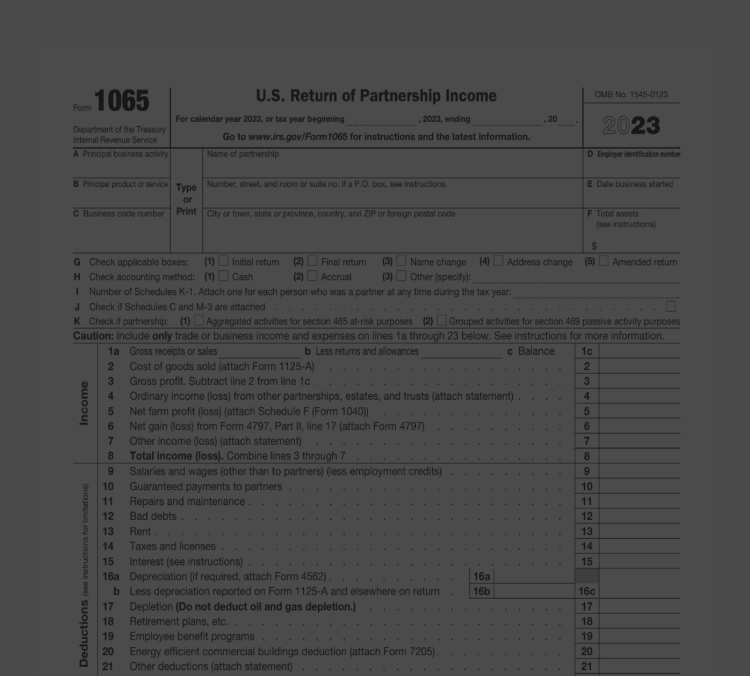

How to fill out Form 1065?

Access PDF Master and choose the blank form 1065 (U.S. Return of Partnership Income).

At the top of the form, fill in your partnership's name, address, and Employer Identification Number (EIN).

Accurately report the partnership's income, including gross receipts, sales, and other types of income, and record deductible expenses like salaries, rent, and taxes.

Carefully check all the entered financial details for accuracy, ensuring all income and expenses are correctly reported.

Once you've reviewed the form and confirmed its accuracy, save and download the completed form 1065 securely using PDF Master.

After downloading Form 1065, proceed to complete the necessary schedules, such as Schedule K and K-1, according to IRS guidelines. These schedules are essential for IRS filing.

With the completed form 1065 and schedules, you're ready for the IRS filing. While PDF Master provides the tools for form preparation, remember that it doesn't handle the actual filing. You'll need to submit the completed form and schedules to the IRS as required.

What is a schedule K-1 (Form 1065)?

Schedule K-1 (Form 1065) is used to report each partner's share of the partnership's income, deductions, credits, and other items. The form is used to determine each partner's tax liability and to allocate profits and losses to the partners. One Schedule K-1 must be generated for each partner for every tax year - without these forms, partners would lack the information to file their taxes properly.

Other schedules that may be required to be filed with Form 1065 include Schedule B, Schedule M-1, and Schedule M-2. Here's a brief overview of each schedule:

- Schedule B: This schedule is used to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, more than 50% of the partnership. It is not required if the partnership has no such owners.

- Schedule M-1: This schedule is used to reconcile the income reported on Form 1065 with the income reported on the partnership's income tax return. It shows the reconciliation of income (loss) per books with income (loss) per tax form.

- Schedule M-2: This schedule is used to analyze each partner's capital account. It shows the changes in each partner's capital account from the beginning to the end of the tax year. The changes are reported on Schedule M-2, and the schedules of the partners are attached to the return

Simplify Tax Reporting with PDF Master's 1065 Form Filler

Frequently asked questions

How to file Form 1065 online?

When is Form 1065 due?

What taxes are deductible on line 14 of Form 1065?

How to report PPP loan forgiveness on Form 1065?

PDFMaster.app and our partners use cookies. By using this site you agree to our use of cookies as described in our Privacy Policy and Cookie Tracking Policy